Articles

Center Store Shopping Trends for 2024 and Beyond

Gain a better understanding of center store shopping trends and learn what’s driving this store section’s evolution.

The main role of the center store section has been to offer ambient packaged food and other shelf-stable products. And although this role won’t be disappearing anytime soon, more grocers—and big box retailers—are making center store changes. But why?

In the following, we’ll explain what’s driving the center store’s evolution with the help of retail consultant Jack O’Leary, head of consulting, North America, for the commerce consulting firm Flywheel Digital. We’ll also discuss center store shopping trends and real-world innovations.

In this video, get a helpful overview of center store shopping trends from retail consultant Jack O’Leary, part of our What’s in Store series.

The Role of E-Commerce in the Store Layout’s Evolution

Brick-and-mortar retailers are well aware of e-commerce’s rapid growth rate. But it’s also important to understand that this growth is actually affecting future store layouts.

For instance, based on research conducted by Flywheel, O’Leary says more and more large-format grocery stores in Western markets are shifting their space allocation. A major example of this can be seen with expanding space allocation trends in the store perimeter.

With its perishable food essentials, this store section is gaining new prominence—and more square footage—because it offers items and experiences “that can’t be easily replicated or sold online,” explains O’Leary.

On the other hand, as the following graphic illustrates, Flywheel expects center store space allocation to shrink. One major reason is the shift in shopper behavior. As O’Leary explains, “utilitarian shopper needs for this part of the store are going down” because many items traditionally found in the center store can be conveniently purchased online.

Here are more specific predictions from the Flywheel team on how the sales floor may change over the next five to ten years:

- 30% less space to center store merchandising

- 20% less space to the checkout area

- 25% more space to online fulfillment area

- 15% more space to perimeter products and experiences

- 5% more space to non-retail offerings

Reimagining the Center Store

O’Leary clarifies that there are still plenty of classic center store product categories with in-store purchasing volumes that far exceed online shopping. A few examples include pet food, baby food, and household cleaning products.

He adds that these and other still-robust center store categories should provide impetus for retailers to “defend” the center store. One way to do that is by reimagining this store section as a place to promote shopper engagement and meet the increasing need for what he calls “experiential shopping.”

This means having a center store that, for example, educates shoppers about products and/or presents items in ways that surprise and delight them.

Let’s take a look at some actual innovations that O’Leary says are impacting the center store shopping experience.

Next-Gen Center Store Innovations

Encouraging shopper engagement. More retailers are making an effort for center store aisles to become a place for customers to dive deeper and experience product categories in a more meaningful way.

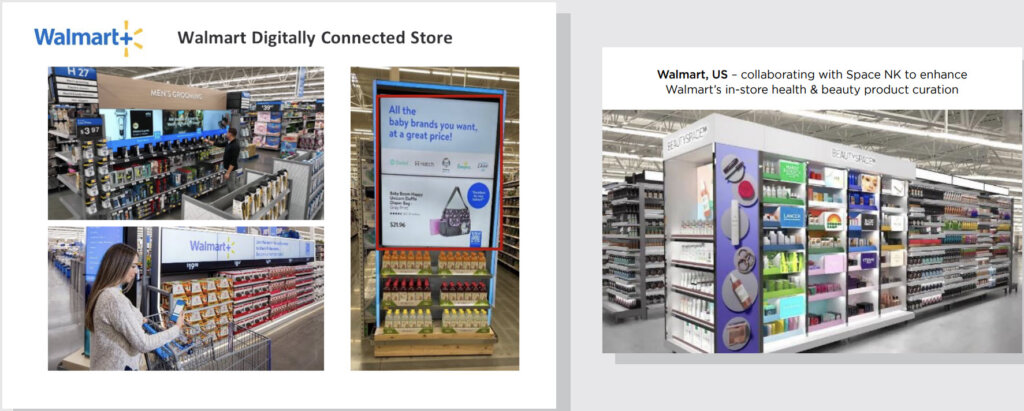

Walmart’s new store concept “Time Well Spent” exemplifies this. The initiative includes design principles that encourage shopper dwell time and engagement via digital touch points like QR codes and screens. These enable customers to learn about product features and options, as well as place orders for home delivery.

Other features include curated product selections, activated corner areas that invite customers to become part of the space, and a next-level store-within-a-store (more on those below).

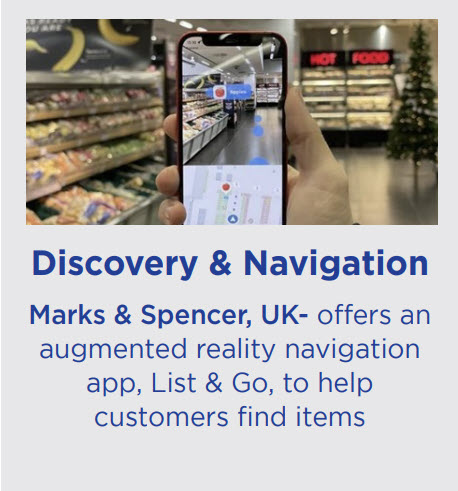

Helping shopper navigation. Retailers are also leveraging digital technology to help shoppers more easily locate products in the center store.

A perfect example is List & Go, an augmented reality navigation app offered by UK-based Marks & Spencer. The app lets customers enter their shopping list and follow an on-screen navigation path to locate items more efficiently.

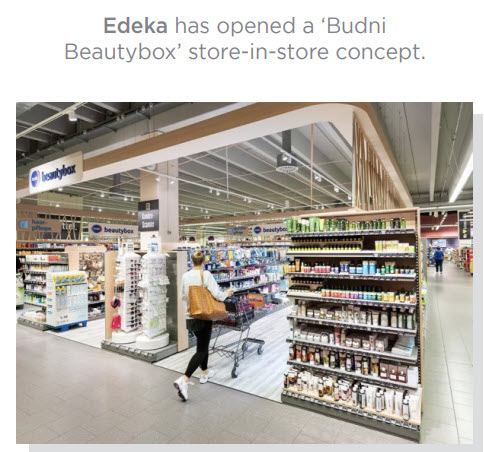

Offering A More Formalized Store-Within-a-Store. Expect an increase in more formalized store-within-a-store sales floor spaces.

For instance, in Europe the beauty company Edeka is trialing a new “Beautybox” store-within-a-store concept with Budni, one of Germany’s largest drugstore chains. Highlights of the initiative include the use of separate flooring and lighting to create a completely different retail experience from the rest of the store.

What (and Who) to Watch on the Horizon

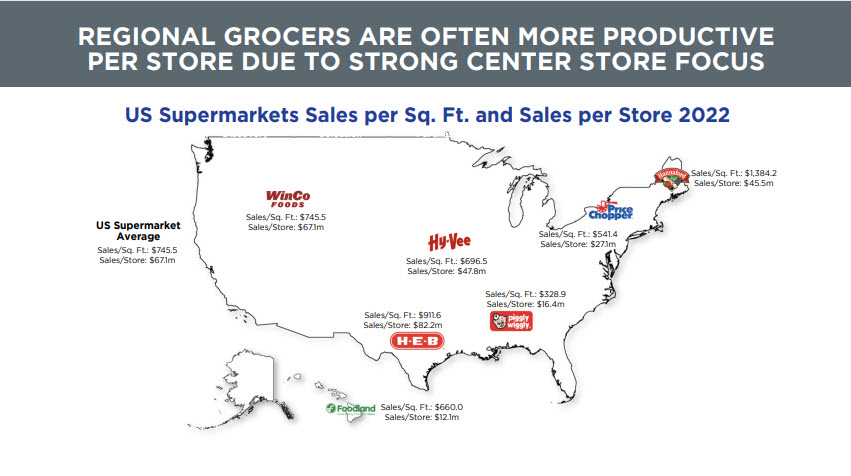

Given the potential for center store compression and store layout reorganization, O’Leary says to keep a close eye on the retailers that are maximizing the productivity of their square footage.

Regional grocers in particular are often more productive on a per-store and per-square-foot basis. For example, according to Flywheel data, the U.S. supermarket average for annual sales per store is around $9.2 million.

Now compare that with regional supermarket powerhouses like Price Chopper at $27 million, Hannaford at $45 million, WinCo Foods at $67 million, and HEB at $82 million.

“Some of the regional players have really figured out and cracked this, at least for grocery center store experience,” says O’Leary, “and are driving great productivity to these locations relative to the channel average. And so they’re a good one to watch.”

Summarizing the Center Store’s Future Potential

So what should be the key takeaways when we think about the center store’s evolution? O’Leary says the transformation of the center store will likely revolve around retailer efforts to engage, educate, and entertain shoppers.

In addition, he says to look for retailers to experiment more with center store initiatives that involve collaborating with brands in innovative ways.

Learn more about how these retail solutions can work for you.