Articles

4 Innovation-Driven Strategies Redefining Retail Labor

Discover four innovations helping retailers cut labor costs, streamline operations, and thrive in a high-pressure market.

Labor is one of retail’s biggest challenges and largest expenses. Mounting economic pressure and fluctuating workforce availability are forcing stores to reimagine how work gets done. So what’s a possible solution?

“Retailers today are turning to innovation as a core strategy to reduce labor costs and drive greater efficiency,” says Chad Widdison, head of consulting at Flywheel Digital.

That’s leading to a wave of new approaches and tech-forward strategies designed to streamline operations. Let’s look at four labor-related innovations that are helping retailers not just survive but thrive. But before we do, let’s consider the economic pressures forcing retailers to rethink their labor strategies.

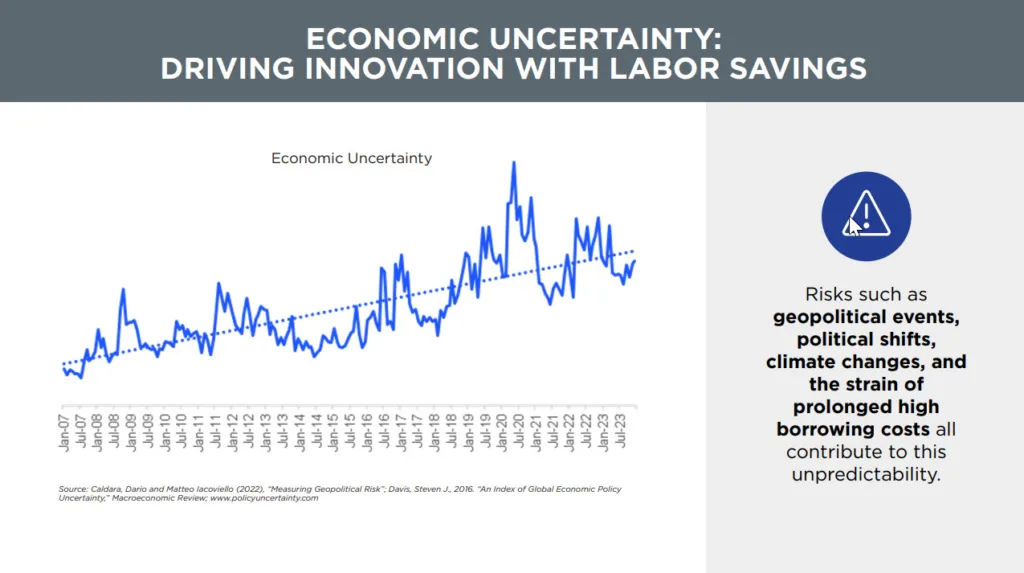

Understanding the Pressures Behind Labor Innovation

From global conflicts and shifting trade policies to prolonged high borrowing costs, today’s economic environment is unpredictable. Experts suggest that the next ten years may see even more market volatility.

“For retailers, this means a renewed focus on cost efficiency and reallocating staff to roles where human interaction is critical,” says Widdison. Retailers are also looking at technology options as a way to maintain resilience.

But these efforts aren’t just about resilience. Innovations like the following give retailers the flexibility to adapt operations quickly when conditions shift.

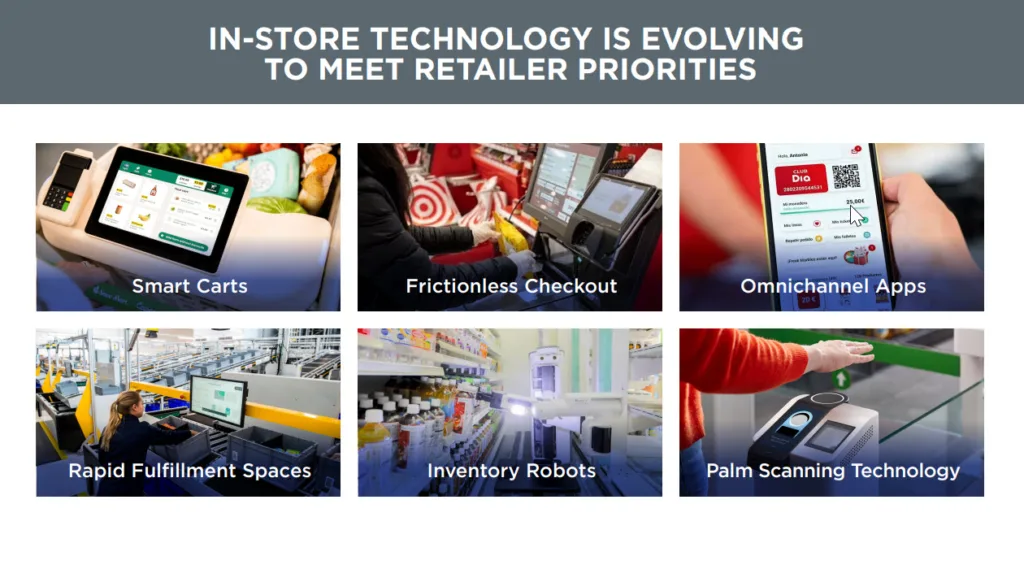

1. In-Store Tech Streamlines Work and Service

Today’s in-store tech is no longer experimental—it’s central to efficiency. Widdison says innovations like smart carts, frictionless checkout, and palm scanning are making the shopping experience smoother.

Just as important are the new developments behind the scenes. Inventory robots, omnichannel apps, and backroom fulfillment hubs (see below) are reducing manual work and improving throughput.

These tools support leaner labor models while helping retailers deliver accuracy and personalization at scale.

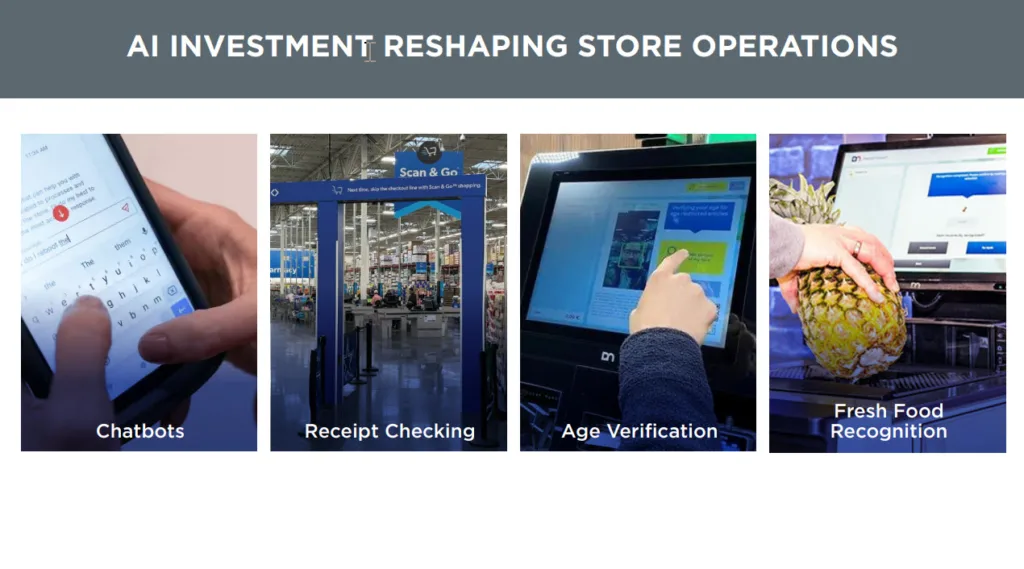

2. AI Sharpens Decisions and Cuts Costs

Retailers are increasingly using AI to automate routine work, forecast demand, and support both staff and customers.

According to a recent survey of 400 retailers, top AI use cases include:

- Store analytics

- Adaptive promotions

- Conversational AI

- Inventory management

- Loss prevention

“In practice, we see solutions such as generative AI, chatbots for employee support, AI-powered receipt checking, automated age verification, and fresh food recognition,” says Widdison.

By turning raw data into real-time actions, AI is helping retailers make faster decisions, control costs, and improve consistency across store operations.

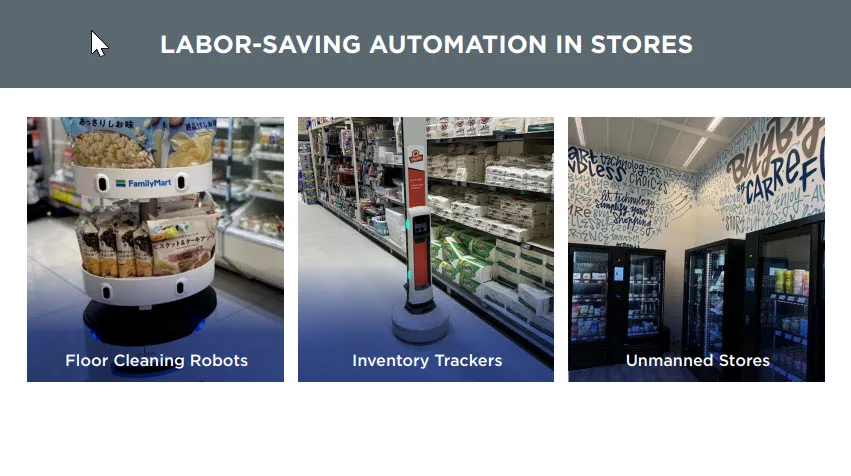

3. Automation Fills Labor Gaps Where It Matters Most

With labor markets tight, retailers are leaning on automation to cover critical tasks and redeploy staff where they add the most value.

Robots that once seemed niche are now everyday tools in high-traffic or high-turnover stores. Unlike conventional equipment, today’s systems can work across departments and shifts, giving retailers more flexibility in how labor is allocated.

Key automation strategies include:

- Floor cleaning robots that free up staff for customer-facing roles

- Digital shelf labels that eliminate manual price changes

- Inventory scanning bots that track product movement in real time

- Unmanned store formats in urban, high-demand locations

“Automation is becoming essential to controlling rising operational costs and sustaining store profitability,” Widdison notes.

Rather than replacing people, automation enables smarter labor allocation—allowing staff to focus on service and sales while routine tasks are handled automatically.

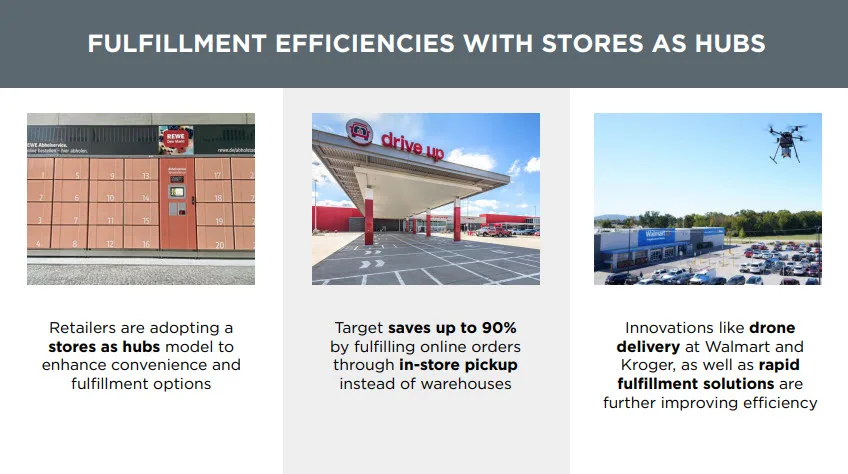

4. Fulfillment Engines Turn Stores Into Profit Drivers

Rising delivery costs are squeezing margins, prompting retailers to use stores as fulfillment hubs.

Local store sites can manage last-mile logistics more effectively than distant warehouses. For example, Widdison points out that Target saves up to 90% by fulfilling online orders through in-store pickup instead of warehouses.

Other fulfillment innovations include:

- Click-and-collect stations with streamlined pickup

- Micro-fulfillment spaces in store backrooms

- Drone delivery pilots at retailers like Walmart and Kroger

This shift improves convenience for shoppers while reducing costs for retailers—making fulfillment a frontline strategy for labor savings and profitability.

Key Takeaways: Innovation Is the New Labor Strategy

Labor savings today isn’t about cutting headcount or settling for shifts that are short-staffed. It’s about redesigning how stores operate. And that means innovating in ways like the following:

- Investing in automation and tech to offset economic uncertainty and rising costs

- Deploying AI and robotics to cut labor needs while boosting efficiency across operations

- Using stores as fulfillment hubs to lower delivery costs and serve shoppers with greater speed and flexibility

“By embracing these trends,” says Widdison, “retailers are positioning themselves for success in a challenging and rapidly changing environment.”

Learn more about how these retail solutions can work for you.